Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

![Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC] Simplifying The Market](https://img.chime.me/image/fs/chimeblog/20240427/16/original_9cd3bacf-d441-4855-93c8-8cdabb9f70cc.png)

Some Highlights

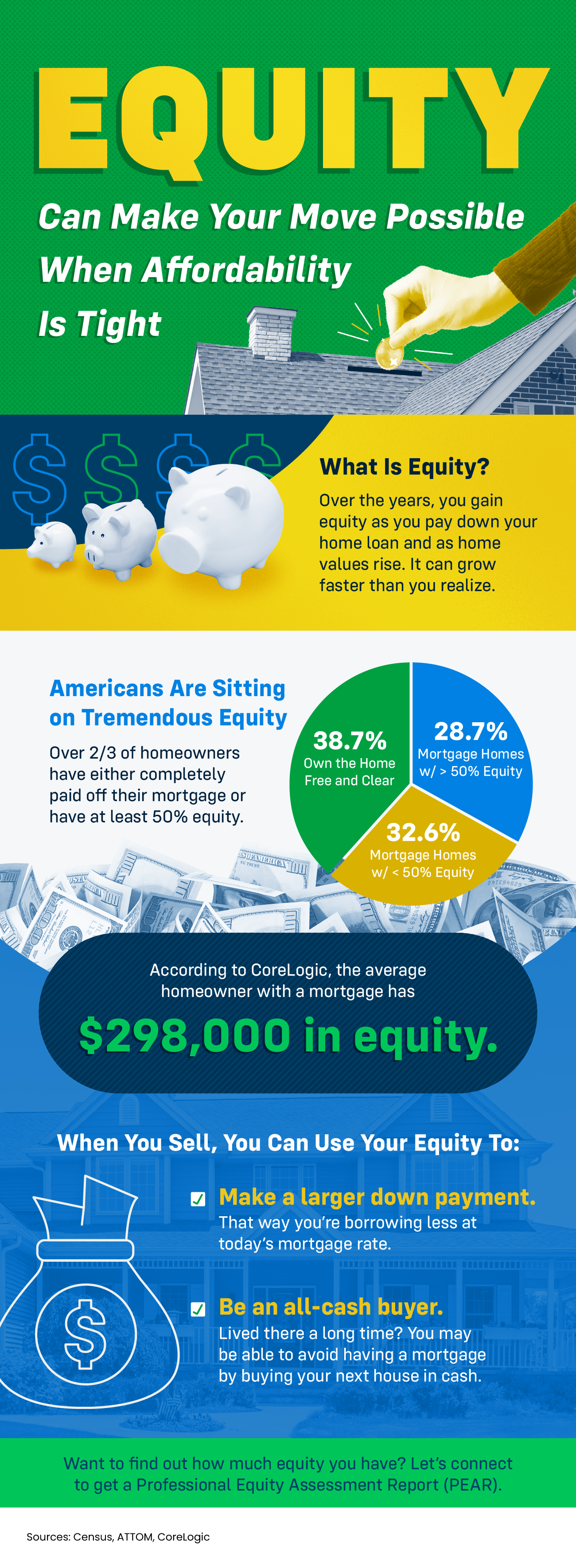

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

Categories

Recent Posts

Are Big Investors Really Buying Up All the Homes? Here’s the Truth.

The #1 Regret Sellers Have When They Don’t Use an Agent

The Credit Score Myth That’s Holding Would-Be Buyers Back

Expert Forecasts Point to Affordability Improving in 2026

Thinking about Selling Your House As-Is? Read This First.

Why Pre-Approval Should Be Your First Step – Not an Afterthought

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Not Sure If You’re Ready To Buy a Home? Ask Yourself These 5 Questions.

Reasons To Be Optimistic About the 2026 Housing Market

Turning a House Into a Home: The Benefits You Can Actually Feel

“My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! ”